発行済み :2023/06/28 7:14:55

クリック数:2103

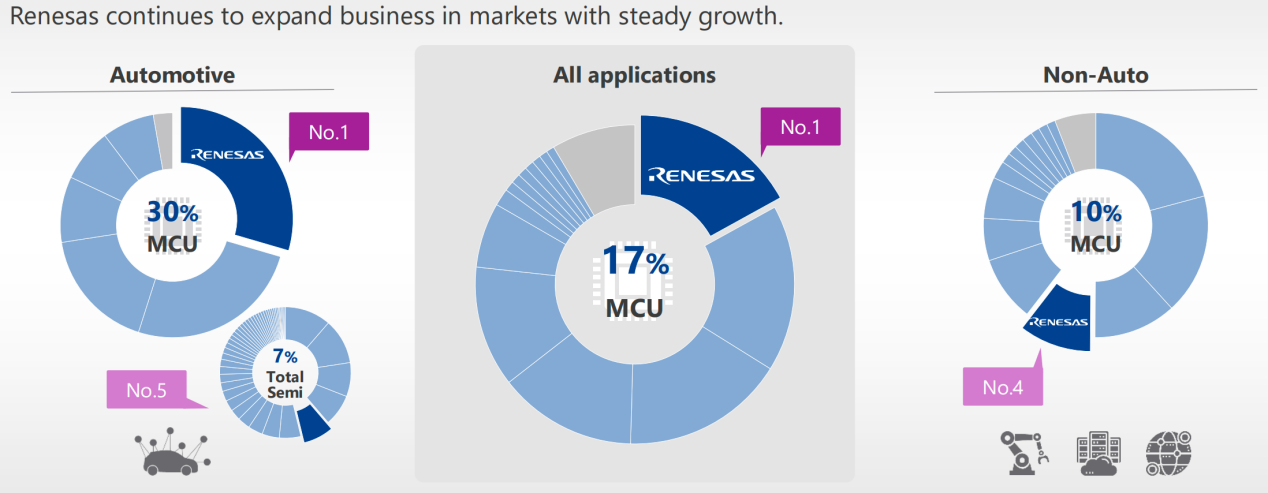

"Currently, there is not much difference in the market share of global TOP3-level MCU manufacturers. It is very challenging to increase the market share by 0.5 or 1 percentage point. Renesas Electronics will account for 16% of the global MCU (all-category applications) in 2021. It is not easy to increase the market share to 17% in 2022." At the media conference of embedded world China 2023 (hereinafter referred to as: ewCN) in Shanghai, Vice President of Global Sales and Marketing Division of Renesas Electronics And Renesas Electronics China President Lai Changqing (Andy Lai) said so.

In this media conference and the visit to the booth of Renesas Electronics, the word "solution" appeared very frequently. Renesas Electronics uses a variety of innovative solutions to meet the changing needs of the automotive and non-automotive markets, and actively embraces the trend of transition from traditional embedded to embedded intelligence. The system-level innovation capabilities have been reflected in Renesas Electronics.

Empower customers with stable supply and high-quality solutions

As shown in the figure below, as Lai Changqing mentioned, Renesas Electronics has become the No. 1 market share of MCUs in all categories of applications. Among them, in the automotive MCU market, Renesas Electronics has a market share as high as 30%, which is one of the company's core businesses; in the non-automotive MCU market, Renesas Electronics also has a 10% market share, among the manufacturers among the best.

Source: Renesas Electronics

Based on multiple data from IC Insights and Topology Industry Research Institute, the global MCU market will grow strongly after 2020, especially the automotive MCU market, which is expected to explode. Specifically, the global MCU market will reach US$21.5 billion in 2022, and the compound annual growth rate of the market from 2021 to 2026 is expected to reach 6.7%; the global automotive MCU market will be US$8.286 billion in 2022, compared with An increase of 11.4% year-on-year. Obviously, Renesas Electronics has seized this wave of high-speed growth opportunities.

Lai Changqing believes that in the MCU market full of opportunities and challenges, Renesas Electronics can become the number one market share, thanks to the following aspects:

First of all, Renesas Electronics attaches great importance to research and development, and about 18% of the company's revenue is invested in research and development, which enables Renesas Electronics to continue to provide customers with competitive products.

·Secondly, Renesas Electronics has inherited the Japanese company's culture and spirit of excellence, and has a very good market reputation among customers in the automotive industry and non-automobile industry customers.

The third point is to provide customers with guaranteed supply, even when the supply chain has been tight in the past year or two, which has earned Renesas Electronics the respect of customers.

·The fourth point is that Renesas Electronics is paying more and more attention to the Chinese market, expanding its sales and technical support teams in China, and bringing better localized services to Chinese customers.

The fifth point is to strengthen one's own business capabilities through mergers and acquisitions, especially the mergers and acquisitions of the software business, which will make Renesas Electronics' business more diversified, and the solution will have the advantage of differentiated competition.

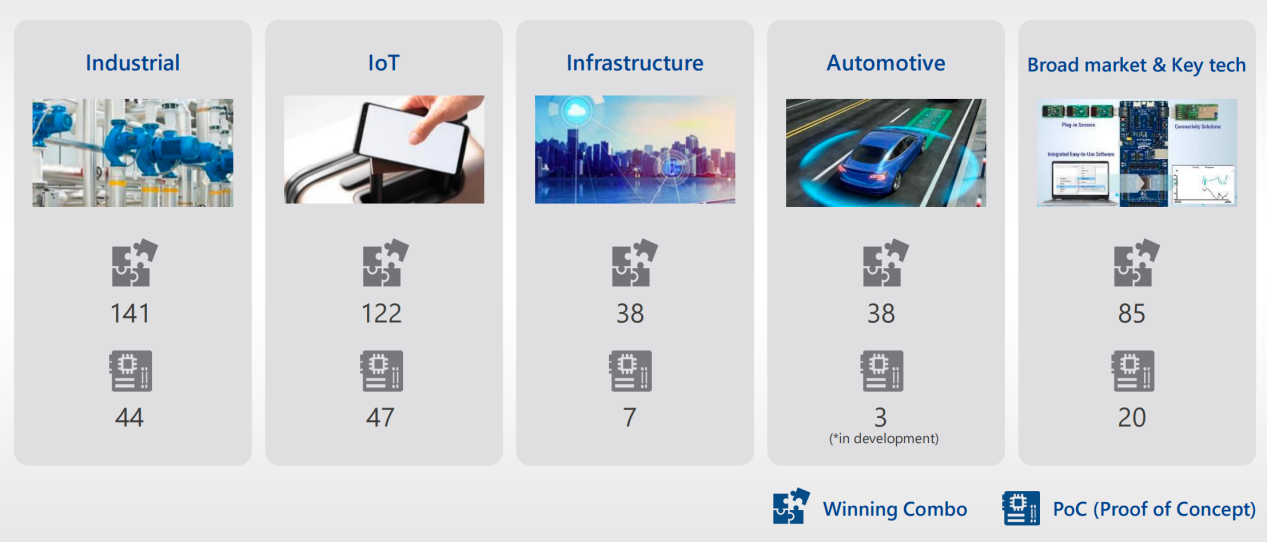

"We hope that by 2030, the company's sales can change from 12 billion US dollars in 2022 to 20 billion US dollars, becoming the world's top three embedded semiconductor solution providers. Renesas Electronics has been vigorously promoting solutions since 2019, and by 2022 In 2018, we had more than 400 sets of overall solutions. We will launch solution reference designs for different applications, many of which are very recognized and accepted by customers, and can be further transformed into their products.” Lai Changqing said, “At the same time, Renesas Electronics also Continuously optimizing the supply of products. When the supply chain becomes more and more complex and there are more changes in supply and demand, safety stock is very important, reflecting that a company can provide more value to customers. In order to make inventory or supply More flexible and healthier, we will prepare some semi-finished products to finished products - the stocking at different stages after the packaging and testing, so that our delivery period can be shortened as much as possible, but at the same time we can be more flexible. Our inventory goal is to restore the delivery period to three The industry average level of about 2-3 months a year ago."

The solution provided by Renesas Electronics, source: Renesas Electronics

Empower intelligent and connected new energy vehicles with innovative solutions

For MCU manufacturers including Renesas Electronics, the automotive market will be one of the most core and important markets in the foreseeable future. Under the concept of intelligent network connection and new energy, the demand for MCU in automobiles is increasing year by year. According to the research report data of CITIC Securities, the MCU consumption of traditional fuel vehicles is about 50-100 per vehicle. At this stage, the MCU consumption of new energy vehicles with intelligent network connection functions has reached 300. This number will continue to increase in the future.

Mingyu Zhao, Vice President of Automotive Electronics Strategic Sales Center of Renesas Electronics Global Sales and Marketing Division, pointed out: "According to our forecast, the production of automobiles will grow at a rate of 1.1 times per year from 2019 to 2029. During this period, automotive semiconductors will The amount will grow at a rate of 2.4 times per year. If you consider that the number of chips used in a single vehicle will increase by 6 times or even 10 times from traditional fuel vehicles to pure electric vehicles, this forecast is not radical.”

Zhao Mingyu introduced Renesas Electronics' support for the development of new energy vehicles with intelligent network connection functions from four levels: E/E architecture, intelligent driving, EV, and cross-domain integration.

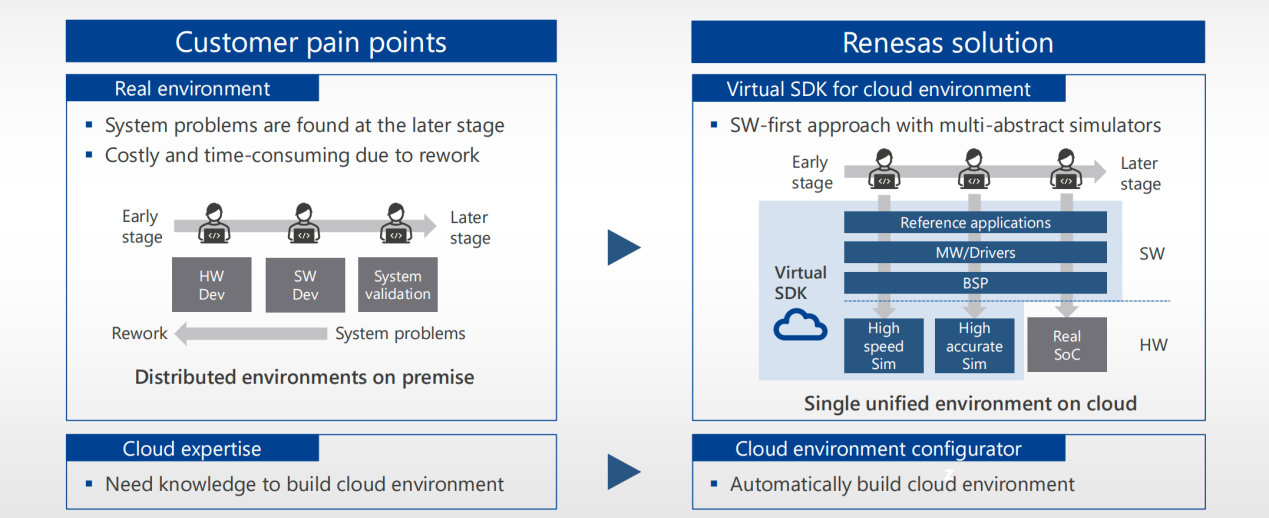

In terms of E/E architecture, Renesas Electronics has achieved a compound annual growth rate of 43% in this market segment. In response to differentiated requirements such as functional integration, domain control, and domain fusion, Renesas Electronics has launched a series of high-performance products such as the RH850 and R-Car. In addition, the concept of shifting the system to the left is put forward in a targeted manner. Through innovative means such as cloud software, simulators, and simulation incentives, software engineers and hardware engineers can achieve simultaneous development, and the intervention time of system verification engineers is greatly advanced, improving the efficiency of program development. efficiency.

The concept of system left shift proposed by Renesas Electronics, source: Renesas Electronics

In terms of intelligent driving, Renesas Electronics' performance in this segment has a compound annual growth rate of 36%. Previously, Renesas Electronics' R-Car products were mainly oriented to vision applications, and the short board of the product camp was that there were no sensors. To this end, Renesas Electronics has acquired Steradian, a millimeter-wave radar-related company. Based on this, Renesas Electronics has the complete solution capability of vision + perception in intelligent driving. "Renesas Electronics' millimeter-wave radar products are based on a 28-nanometer CMOS process, which is at least one generation ahead of the millimeter-wave radar products that everyone sees on the market. Therefore, if the user's solution is switched to Renesas Electronics' radar products, the resolution will be reduced. Increased by 20%-30%, power consumption will be reduced by 30%." Zhao Mingyu said in the introduction.

At present, Renesas Electronics is investing heavily in research and development to improve the performance of the R-Car series products, providing products with different computing power levels from 30T to 2000T, and satisfying the differentiation from low-end driving and parking integration to L4 and above autonomous driving need.

In terms of EV, the compound annual growth rate of Renesas Electronics' performance in this segment is also 36%. Renesas Electronics has launched a wealth of EV solutions, including motor solutions, BMS solutions, DC/DC solutions, OBC solutions, etc. In these solutions, Renesas Electronics not only provides basic hardware reference and software support, but also places some core algorithms in the cloud to help users improve development efficiency. In the field of silicon carbide (SiC), which is more concerned by the industry, Renesas Electronics already has a 6-inch product line and plans to mass-produce an 8-inch product line in 2025.

In terms of cross-domain integration, Renesas Electronics has effectively integrated some original industrial and consumer-oriented product IPs into automotive-grade products. For example, the traditional UWB or Bluetooth chip is modified to create a wireless BMS system; the traditional Wi-Fi chip is modified to create a tire pressure management system.

A variety of products appeared on ewCN

At this ewCN, Renesas Electronics demonstrated a wealth of solutions, which well explained the above concepts. These solutions include Internet gateway solutions for future automotive E/E architectures, overall solutions for new energy vehicle motor Lens-parallel AI object recognition solution, RZ/A3UL quick start graphical user interface solution, and intelligent motor drive control and charging management integrated solution, etc.

Through these solutions, it is not difficult to see that Renesas Electronics is one of the main promoters of the intelligent upgrade of embedded products, providing a source of innovation for embedded fields such as automobiles, industry, Internet of Things and infrastructure.